Why in News?

-

India is exploring catastrophe bonds.

-

As a financial innovation to strengthen disaster risk financing

-

-

Aim:

-

Enhance climate resilience amid rising frequency of natural disasters

-

Introduction:

-

Climate change has increased the frequency/severity of disasters:

-

Cyclones

-

Floods

-

Earthquakes

-

-

Traditional insurance coverage is limited:

-

Especially for individuals/small businesses

-

-

Catastrophe bonds (cat bonds) offer an alternative:

-

By transferring disaster risk to global capital markets

-

-

Benefits:

-

Faster payouts

-

Improved post-disaster recovery

-

Reduced pressure on public finances

-

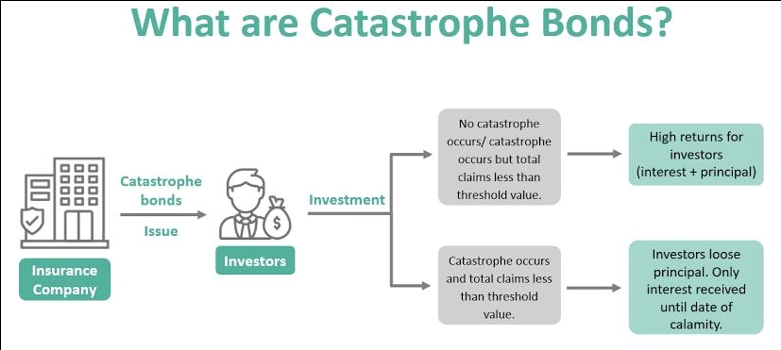

Understanding Catastrophe Bonds:

-

Hybrid instrument:

-

Mix of insurance and debt

-

-

Issued by at-risk entities (usually sovereign states):

-

To transfer predefined risks to investors

-

-

If disaster strikes:

-

Investors lose principal, used for relief/reconstruction

-

-

If no disaster:

-

Investors receive full principal + high interest (coupon rate)

-

-

Key features:

-

Tradable security

-

Attracts wider capital beyond insurers

-

Faster payouts and lower counterparty risk

-

Key Stakeholders and Mechanism:

-

Sponsors:

-

Sovereign governments (pay premiums)

-

-

Issuers/Intermediaries:

-

e.g., World Bank, Asian Development Bank (mitigate issuance risk)

-

-

Investors:

-

Global players like pension funds, hedge funds, family offices

-

-

Coupon rates depend on:

-

Risk level and frequency of disaster

-

Example:

-

Earthquake bonds = lower premiums (1–2%)

-

Cyclone bonds = higher returns

-

-

Global Adoption and Profitability:

-

Origin:

-

Late 1990s post-major U.S. hurricanes

-

-

Total $180 billion issued globally:

-

$50 billion outstanding

-

-

Diversification value:

-

Natural disasters are non-correlated with market risks

-

-

Aligns with:

-

Harry Markowitz’s diversification theory

-

-

Attractive risk-return profile:

-

Especially during market volatility

-

India’s Need for Cat Bonds:

-

High climate vulnerability:

-

Increasing floods

-

Cyclones

-

Forest fires

-

Earthquakes

-

-

Low insurance penetration, high public expenditure on reconstruction

-

Benefits of Cat Bonds for India:

-

Protects public finances during disasters

-

Leverages sovereign credit rating for better terms

-

Enables swift access to relief funds

-

-

India’s Rs. 15,000 crore ($1.8B) annual disaster management budget:

-

Could reduce bond premiums

-

Regional Collaboration – South Asian Cat Bonds:

-

Proposal:

-

India could lead a regional cat bond framework

-

-

Advantages:

-

Risk pooling across multiple South Asian nations

-

Lower premiums, enhanced investor interest

-

Improved regional financial resilience

-

-

Potential coverage:

-

Earthquakes:

-

India, Nepal, Bhutan

-

-

Cyclones/tsunamis:

-

India, Bangladesh, Maldives, Myanmar, Sri Lanka

-

-

Challenges and Considerations:

-

Trigger conditions can be rigid:

-

Example: A bond triggered at ≥6.6 magnitude won’t pay out for a 6.5 quake, despite heavy damage

-

-

Perception of waste:

-

If no disaster triggers payout

-

-

Key considerations for India:

-

Cost-benefit analysis vs. historical recovery spending

-

Accurate trigger thresholds and geographic coverage

-

Collaboration with credible intermediaries and risk modeling experts

-

Conclusion:

-

Catastrophe bonds represent a forward-looking, market-based solution

-

To manage the growing financial risks of climate disasters

-

-

For a vulnerable yet rapidly developing country like India, they offer:

-

A chance to stabilize public finances

-

Accelerate disaster response

-

Unlock global capital for climate resilience

-

-

However, their success depends on:

-

Careful design of payout triggers

-

Transparent cost analysis

-

Engagement with reliable global partners

-

-

With the right approach, India can:

-

Safeguard its own future

-

Lead regional cooperation in South Asia through a shared catastrophe bond framework

-

Set an example for climate risk governance in the Global South

-