Why in News?

-

The Finance Minister reported in the Rajya Sabha that:

-

5,892 cases have been taken up by the Enforcement Directorate (ED) under the Prevention of Money Laundering Act (PMLA) 2002 since 2015.

-

Out of these cases, only 15 convictions have been secured by special courts.

-

-

This raises serious concerns about:

-

The increasing number of money laundering cases

-

The low conviction rate

-

The effectiveness of the law in tackling such financial crimes

-

What is Money Laundering?

-

Definition (Section 3 of PMLA):

-

Money laundering refers to any process or activity connected with the proceeds of crime where such proceeds are concealed, possessed, acquired, or used and projected as untainted property.

-

-

It involves:

-

Disguising illegally obtained money

-

Making it appear legitimate or legal

-

Origin of the Term “Laundromat”

-

The term comes from:

-

The use of laundromats (self-service washing facilities) by organised crime syndicates in the United States as fronts to hide illegal money

-

-

Today, it broadly represents financial vehicles such as:

-

Shell companies or fake businesses used to:

-

Launder proceeds of crime

-

Hide ownership of assets

-

Evade taxes and currency restrictions

-

Transfer money offshore

-

-

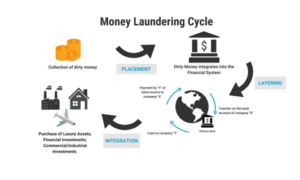

Stages of Money Laundering

Placement

-

The initial stage where illicit money is introduced into the financial system

-

Techniques include:

-

Smurfing: breaking large amounts of cash into smaller deposits to avoid detection

-

Layering

-

Funds are moved across accounts or jurisdictions to obscure their origin

-

Involves:

-

Multiple complex financial transactions

-

Investments and transfers to create confusion

-

Integration

-

The final stage where laundered money re-enters the economy appearing legitimate

-

It is invested in:

-

Real estate

-

Businesses

-

Luxury goods

-

Other assets

-

Impact of Money Laundering

Economic Effects

-

Expands money supply and distorts financial markets

-

Affects monetary stability and inflation

-

Impacts trade by enabling:

-

Unfair competition

-

Illegal funding

-

National Security Risks

-

Linked to:

-

Terror financing

-

Organised crime

-

-

Undermines:

-

The sovereignty and integrity of the nation (Supreme Court, P. Chidambaram vs ED, 2019)

-

International Reputation

-

Weak enforcement affects:

-

India’s credibility in global financial systems

-

-

Can invite:

-

Scrutiny from global bodies like the Financial Action Task Force (FATF)

-

Legal Framework in India – Prevention of Money Laundering Act (PMLA), 2002

Purpose

-

To prevent and control money laundering

-

To confiscate property derived from or involved in money laundering

Key Features

-

Burden of Proof: Lies on the accused to prove that the money is legitimate

-

Enforcement Case Information Report (ECIR): Considered equivalent to an FIR and sufficient to initiate proceedings (Vir Bhadra Singh vs ED, 2017)

-

Scheduled Offences: The act of money laundering is dependent on the existence of a “scheduled offence” (predicate offence)

Judicial Interpretations

Vir Bhadra Singh vs ED (2017)

-

Held that no FIR is required to initiate proceedings

-

ECIR is sufficient

-

Chidambaram vs ED (2019)

-

Emphasised that:

-

Concealing illegal sources of money affects sovereignty and national integrity

-

Vijay Madanlal Chaudhury vs Union of India (2022)

-

For initiating prosecution under Section 3:

-

A registered scheduled offence is required

-

-

However, under Section 5:

-

Property attachment can be done without a pre-registered criminal case

-

This has led to misuse by authorities

-

Issues with Implementation of PMLA

Low Conviction Rate

-

Only 15 convictions out of nearly 5,900 cases since 2015

Increasing Cases

-

The rising number of money laundering cases indicates:

-

Gaps in enforcement and deterrence

-

Alleged Misuse

-

Cases of politically motivated misuse have been highlighted by the Supreme Court

Complex Process

-

Investigation and prosecution are often:

-

Slow

-

Involve extensive financial tracking across jurisdictions

-

International Measures – FATF and Global Standards

Financial Action Task Force (FATF)

-

An intergovernmental body that:

-

-

Sets global standards for anti-money laundering (AML) and counter-terrorist financing (CFT)

-

-

Recommends:

-

-

Strict regulations

-

Reporting mechanisms

-

International cooperation

-

-

India is:

-

-

A member of FATF

-

Expected to comply with its guidelines

-

Double Taxation Avoidance Agreement (DTAA) and Its Role

What It Is?

-

A treaty signed between two or more countries to:

-

Avoid double taxation of the same income

-

-

India has signed DTAA with:

-

About 85 countries

-

How It Helps in Preventing Money Laundering

-

Facilitates:

-

Exchange of tax and financial information between participating countries

-

-

Helps:

-

Track suspicious cross-border transactions

-

Identify illegal fund transfers

-

-

Assists tax authorities in:

-

Identifying cases of tax evasion and related money laundering activities

-

Way Forward

Strengthen Enforcement Mechanisms

-

Modernise investigation tools

-

Use technology-driven financial tracking

Increase Conviction Rate

-

Improve coordination between:

-

ED, judiciary, and police

-

-

Ensure faster trials

Prevent Misuse

-

Ensure checks and balances

-

Stop politically motivated investigations

Global Cooperation

-

Enhance information-sharing under DTAA

-

Collaborate closely with:

-

FATF

-

Other nations

-

Public Awareness

-

Educate:

-

Businesses

-

Financial institutions

-

-

On compliance and reporting of suspicious transactions

Conclusion

-

Money laundering remains a serious economic and national security challenge in India

-

Despite stringent laws like PMLA and global agreements such as DTAA:

-

Rising cases and low convictions indicate the need for:

-

Stronger enforcement

-

Judicial reforms

-

International cooperation

-

-

-

Tackling money laundering is crucial:

-

Not only for financial stability

-

But also to curb its linkages with terror funding and organised crime

-